by Kenneth Powell | Aug 2, 2024 | Uncategorized

Springfield, Virginia, is a vibrant and sought-after community that offers a unique blend of suburban charm and urban convenience. Located just outside Washington, D.C., this area is known for its excellent schools, diverse dining options, and a variety of recreational activities. If you’re considering buying or selling a home in Springfield, it’s essential to understand the current real estate market dynamics.

A Seller’s Market: High Demand, Low Inventory

There is currently a high level of demand and a low level of inventory in the Springfield real estate market. The Months Supply of Inventory (MSI) currently stands at a meager 0.68. Given the current sales pace, the MSI, a critical metric in real estate, indicates how long it would take to sell all of the homes currently on the market. An MSI below 4 months typically signifies a seller’s market, meaning there are more buyers than homes available. The competition among buyers is particularly fierce. Typically, homes sell within the first week of listing. The Median Sold Price of $720,687 reflects the strong demand for homes in the market, leading to higher sale prices. Sellers are benefiting from the competitive market conditions, while buyers may need to act quickly and be prepared to offer competitive prices to secure a home.

What Does This Mean for Buyers?

For buyers, this means that acting quickly and decisively is crucial. Springfield homes sell quickly, often receiving multiple offers shortly after listing. To navigate this competitive market, consider the following tips:

- Get Pre-Approved: Having a mortgage pre-approval in hand indicates to sellers that you are a serious and qualified buyer.

- Work with the Right Agent: Hire a knowledgeable real estate agent who understands the Springfield market, and knows how to structure offers to get them accepted without overpaying for a home.

- Be Flexible: Being open to different neighborhoods or home styles can increase your chances of finding a suitable property.

What Does This Mean for Sellers?

For sellers, the current market conditions present an excellent opportunity to sell your home quickly and potentially for a premium price. Here are some strategies to maximize your success:

- Stage Your Home: Professional staging can make your home more attractive to potential buyers.

- Price It Right: Setting a competitive price can generate interest and lead to multiple offers.

- Market Aggressively: Utilize online listings, professional photos, videos, virtual tours, social media, and open houses to reach a broad audience of potential buyers.

Neighborhood Insights

There are several neighborhoods in Springfield, each with distinctive features and appeal.

- West Springfield: Known for its excellent schools and family-friendly environment, West Springfield is a top choice for families.

- North Springfield: Offers a mix of older, charming homes and newer developments, providing a variety of options for buyers.

- South Run: Features larger homes and more green space, making it ideal for those seeking a more suburban feel.

Living in Springfield

Residents of Springfield enjoy a high quality of life with access to numerous amenities, including:

- Parks and Recreation: Lake Accotink Park and Burke Lake Park offer outdoor activities like hiking, fishing, and boating.

- Shopping and Dining: The Springfield Town Center features a wide range of retail stores and restaurants, catering to all tastes and preferences.

- Commute: Convenient access to major highways (I-95, I-395, and I-495) and public transportation options make commuting to Washington, D.C., and other areas straightforward.

Bottom Line

Due to its high demand and low inventory, the Springfield real estate market is dynamic and competitive. Whether you’re buying or selling, understanding the local market conditions and working with experienced professionals can help you achieve your real estate goals. With its excellent amenities, strong community spirit, and strategic location, Springfield continues to be a desirable place to live and invest in real estate.

by Kenneth Powell | Jul 3, 2024 | Uncategorized

When buying a home in the DMV area (District of Columbia, Maryland, and Virginia), it’s crucial to understand the various expenses involved in the process. One significant cost to consider is the closing cost, which typically ranges between 2 and 5% of the final sales price. For cash buyers, this is usually around 2%. These settlement fees cover all costs required to transfer the home from the current owner to the buyer and are separate from the down payment. Here’s what you need to know about closing costs, along with an example of how they can impact your home purchase budget.

What Are Closing Costs?

Closing costs encompass a range of fees and expenses that are necessary for the legal transfer of property ownership. They encompass a variety of fees and expenses necessary for the legal transfer of property ownership, including, but not limited to:

- Transfer and Recordation Taxes: These are fees that the state or local government levies in order to record the transfer of the property deed.

- Recording Fees: The local government charges fees to officially record the new deed and mortgage documents.

- Loan Origination Fees: The lender’s charges for processing the loan application and underwriting the mortgage. These fees vary based on the type of loan, the lender, interest rates, and the buyer.

- Court Fees: Fees for any legal processes required during the transaction.

- Lawyer Fees: Legal fees for the attorneys involved in preparing and reviewing closing documents.

- Title Insurance and Search Fees: Costs for ensuring the title is free of liens and verifying the property’s legal ownership.

- Appraisal and Inspection Fees: These are fees for professional evaluations of the property’s condition and market value.

Closing Costs vs. Down Payment

It’s important to note that closing costs are separate from your down payment. While the down payment is a percentage of the home’s purchase price paid upfront to secure the loan, closing costs are additional fees paid at the end of the transaction to facilitate the transfer of ownership.

Example Scenario

Let’s use the following example to show the costs associated with buying a $400,000 home:

- Purchase Price: $400,000

- Down Payment: 3.5%

- 3.5% of $400,000 = $14,000

- Closing Costs: 4%

In this scenario, the buyer needs to prepare a total of $30,000 upfront, which includes $14,000 for the down payment and $16,000 for closing costs.

Bottom Line

Understanding closing costs and how they differ from your down payment is essential for budgeting and financial planning when buying a home. By being informed about these expenses, you can better prepare for the home buying process and avoid any last-minute surprises. Always consult with your real estate agent and financial advisor to get a detailed breakdown of the costs associated with your specific transaction.

If you have any questions or need further assistance, feel free to reach out. I’m here to help you navigate the complexities of home buying and ensure a smooth and successful transaction.

by Kenneth Powell | Jun 18, 2024 | Calvert County Market Info, Uncategorized

According to the low monthly supply of 1.47, the real estate market in Calvert County, Maryland, is currently showing signs of strong demand and limited inventory. At the current sales rate, it would take slightly more than a month and a half to sell every house currently listed. Notable is the 12-Month Change in Months of Inventory, which displays a 13.53% drop from the prior year, suggesting a tightening of supply.

Moreover, the average duration of homes on the market is just nine days, suggesting that they sell quickly after listing. The 99.5% List to Sold Price Percentage, which shows that sellers are getting almost their full asking price, lends more credence to this. Now is the perfect time to sell if you plan to sell in 2024, since buyers want to relocate before the start of the new school year.

Calvert County’s median sales price rose 4.4% in comparison to the previous year. The speedy sales, high selling prices, and minimal inventories all contribute to the $465,00 median sold price. This indicates that buyers are fiercely competing with one another for available properties, which drives up market prices.

All things considered, these figures point to a seller’s market with little supply and strong demand, which is advantageous for sellers trying to get the most out of their investment. In this competitive market, buyers must be ready to move swiftly and decisively to get a property. There’s little indication that the interest rate will drop very soon, while the monthly house prices continue to rise. It may be expensive for buyers who are holding out for a drop in mortgage rates.

I’m here to help with all of your real estate needs, and I’m always happy to answer your questions. Kindly get in touch with me by phone or email.

Real estate trends in Calvert County

by Kenneth Powell | Jun 6, 2024 | Uncategorized

A Home Equity Line of Credit (HELOC) isn’t just a financial tool—it’s a powerful gateway to maximizing your home’s potential. Whether you’re in Calvert County, Charles County, St. Mary’s County, or anywhere in DC, Maryland and Virginia (DMV) area, a HELOC offers homeowners a flexible way to access funds by borrowing against their home’s equity. This can be a smart option for financing major expenses like home renovations, education, or other significant investments.

What is a HELOC?

A HELOC acts similarly to a credit card, giving you access to a predetermined amount of money that you can draw on as needed. Unlike a traditional loan, which provides a lump sum upfront, a HELOC offers a line of credit with a limit based on your home’s equity—your home’s value minus any outstanding mortgage balance. Typically, homeowners can borrow up to 85% of their home’s equity, though this can vary by lender.

How Do HELOCs Differ from Credit Cards?

Both offer revolving credit, but because your home’s equity backs them, lenders consider HELOCs to be less risky. This security often translates to lower interest rates compared to unsecured credit lines like credit cards, making a HELOC a cost-effective option for significant expenses.

Key Benefits and Risks of HELOCs

Advantages:

- Lower Interest Rates: Because HELOCs are secured by your home, they generally offer lower rates than unsecured loans and credit cards.

- Flexibility: You can draw funds as needed during the draw period, typically up to 10 years, paying interest only on the amount you borrow.

- Potential Tax Benefits: According to IRS guidelines, if you use a HELOC for home improvements or to buy or build a primary residence, you may be able to deduct the interest.

Risks:

- Risk of Foreclosure: Failure to repay a HELOC can lead to foreclosure, as your home serves as collateral.

- Variable Interest Rates: Most HELOCs have adjustable rates, which means payments could increase if interest rates rise.

Navigating the HELOC Process

Application Process: Similar to a mortgage application, obtaining a HELOC involves proving your creditworthiness and the value of your home. Be prepared to present documentation like W-2s, pay stubs, mortgage statements, and a credit report.

Fees and Costs: While some lenders offer no-closing-cost HELOCs, others may charge between 2% and 5% of the loan amount. Keep an eye out for annual fees and potential penalties for early closure.

Finding the Best HELOC Option

Before committing, it’s crucial to compare offers from multiple lenders. Start with your primary bank or mortgage provider—they might offer discounts or favorable terms for existing customers. Look for introductory offers that might provide lower rates at the beginning of the loan term.

When to Consider a HELOC

A HELOC is ideal for homeowners planning significant home improvements or other investments that add value to their property. However, it may not be suitable for those with unstable income or plans to move soon, as the associated costs and risks could outweigh the benefits.

HELOC vs. Home Equity Loan: Which Is Right for You?

Deciding between a HELOC and a home equity loan depends on your specific needs. A HELOC offers flexible access to funds with a variable rate, while a home equity loan provides a one-time lump sum with a fixed interest rate, which might be preferable for those needing predictable repayments.

Secure Your Financial Future with a HELOC

HELOCs offer a flexible and efficient way to use your home’s equity to your advantage. By understanding the intricacies and responsibilities involved, you can make an informed decision that aligns with your long-term financial goals. Always consult with financial advisors to ensure this approach fits your overall financial strategy.

Curious About How Much Equity You Have in Your Home?

Find out instantly with our home equity calculator:

Want to know how much equity you have in your home?

by Kenneth Powell | May 10, 2024 | Uncategorized

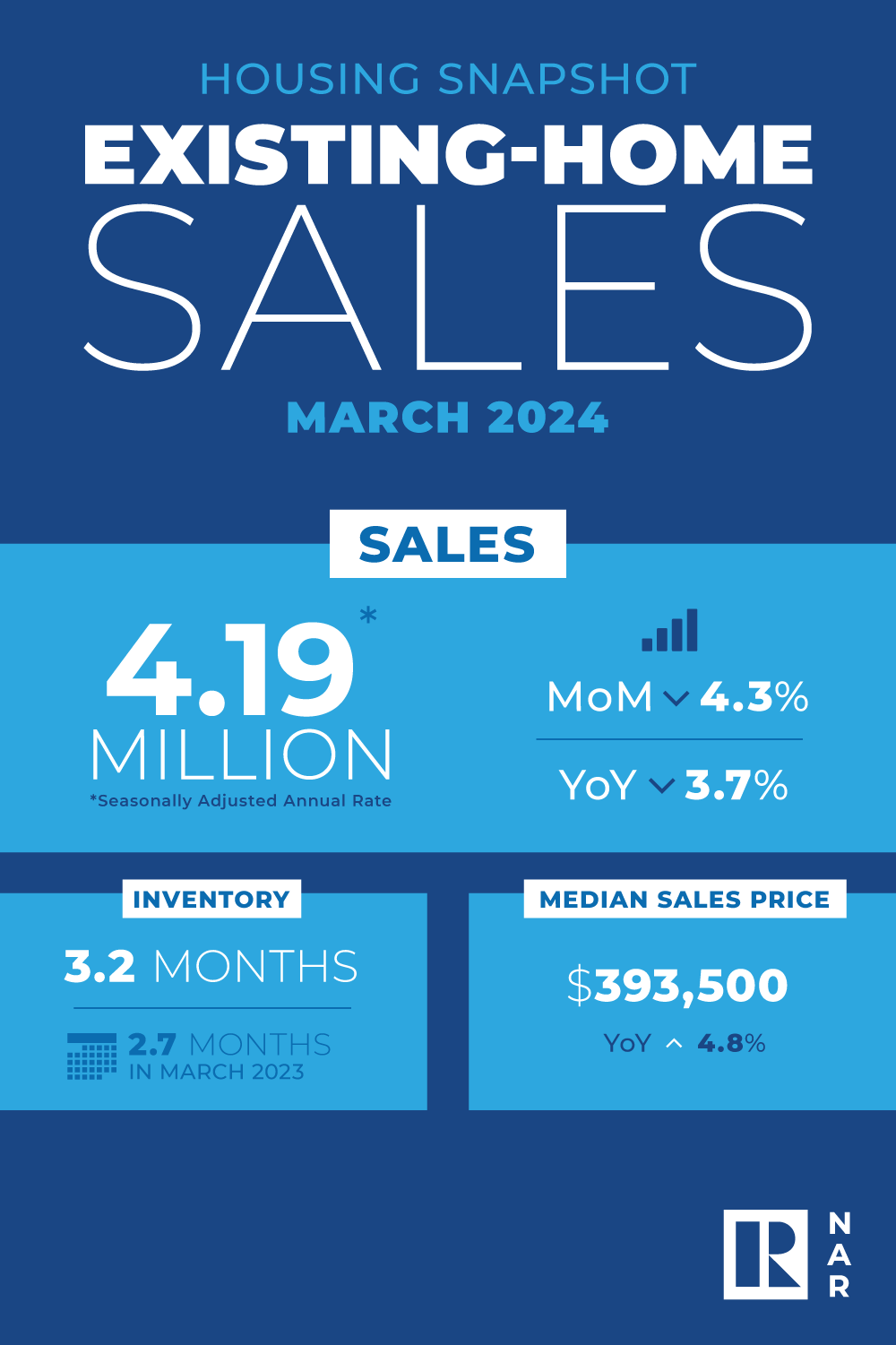

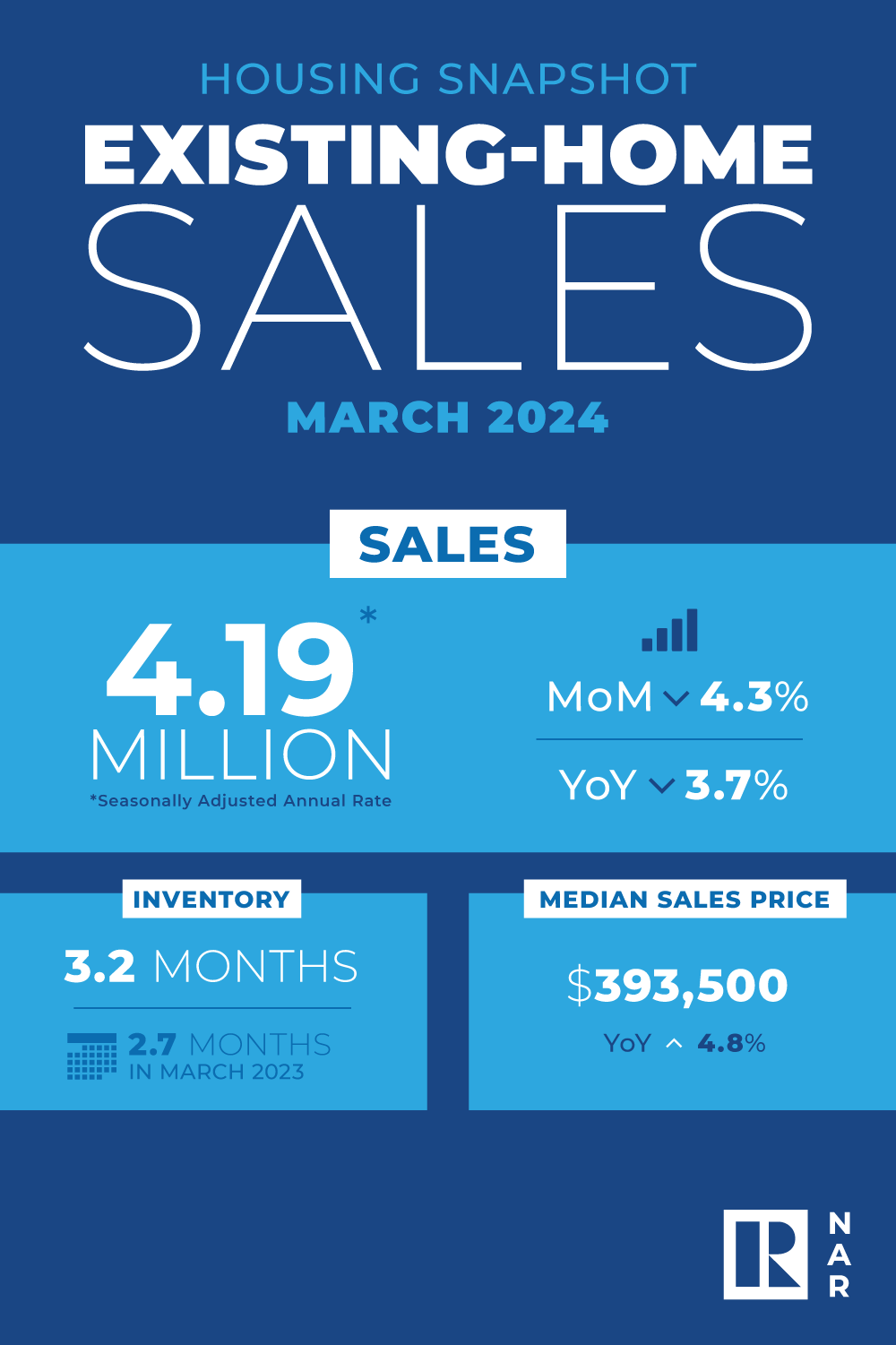

Note: Data below from March 2024 is the most recent from the National Association of Realtors.

Existing-home sales slipped in March, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slid in the Midwest, South and West, but rose in the Northeast for the first time since November 2023. Year-over-year, sales decreased in all regions.

Total existing home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 4.3% from February to a seasonally adjusted annual rate of 4.19 million in March. Year-over-year, sales waned 3.7% (down from 4.35 million in March 2023).

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

Total housing inventory registered at the end of March was 1.11 million units, up 4.7% from February and 14.4% from one year ago (970,000). Unsold inventory sits at a 3.2-month supply at the current sales pace, up from 2.9 months in February and 2.7 months in March 2023.

“More inventory is always welcomed in the current environment,” Yun added. “Frankly, it’s a great time to list with ongoing multiple offers on mid-priced properties and, overall, home prices continuing to rise.”

The median existing-home price for all housing types in March was $393,500, an increase of 4.8% from the previous year ($375,300). All four U.S. regions registered price gains.

According to the REALTORS® Confidence Index, properties typically remained on the market for 33 days in March, down from 38 days in February but up from 29 days in March 2023.

First-time buyers were responsible for 32% of sales in March, up from 26% in February and 28% in March 2023. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 20234 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 28% of transactions in March, down from 33% in February but up from 27% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in March, down from 21% in February and 17% in March 2023.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.88% as of April 11. That’s up from 6.82% the previous week and 6.27% one year ago.

Regional Breakdown

Existing-home sales in the Northeast climbed 4.2% from February to an annual rate of 500,000 in March, ending a four-month streak where sales in the Northeast registered 480,000 units. Compared to March 2023, home sales were down 3.8%. The median price in the Northeast was $434,600, up 9.9% from one year ago.

In the Midwest, existing-home sales retracted 1.9% from one month ago to an annual rate of 1.01 million in March, down 1.0% from the prior year. The median price in the Midwest was $292,400, up 7.5% from March 2023.

Existing-home sales in the South faded 5.9% from February to an annual rate of 1.9 million in March, down 5.0% from one year before. The median price in the South was $359,100, up 3.4% from last year.

In the West, existing-home sales slumped 8.2% from a month ago to an annual rate of 780,000 in March, a decline of 3.7% from the previous year. The median price in the West was $603,000, up 6.7% from March 2023.

by Kenneth Powell | Apr 7, 2024 | Uncategorized

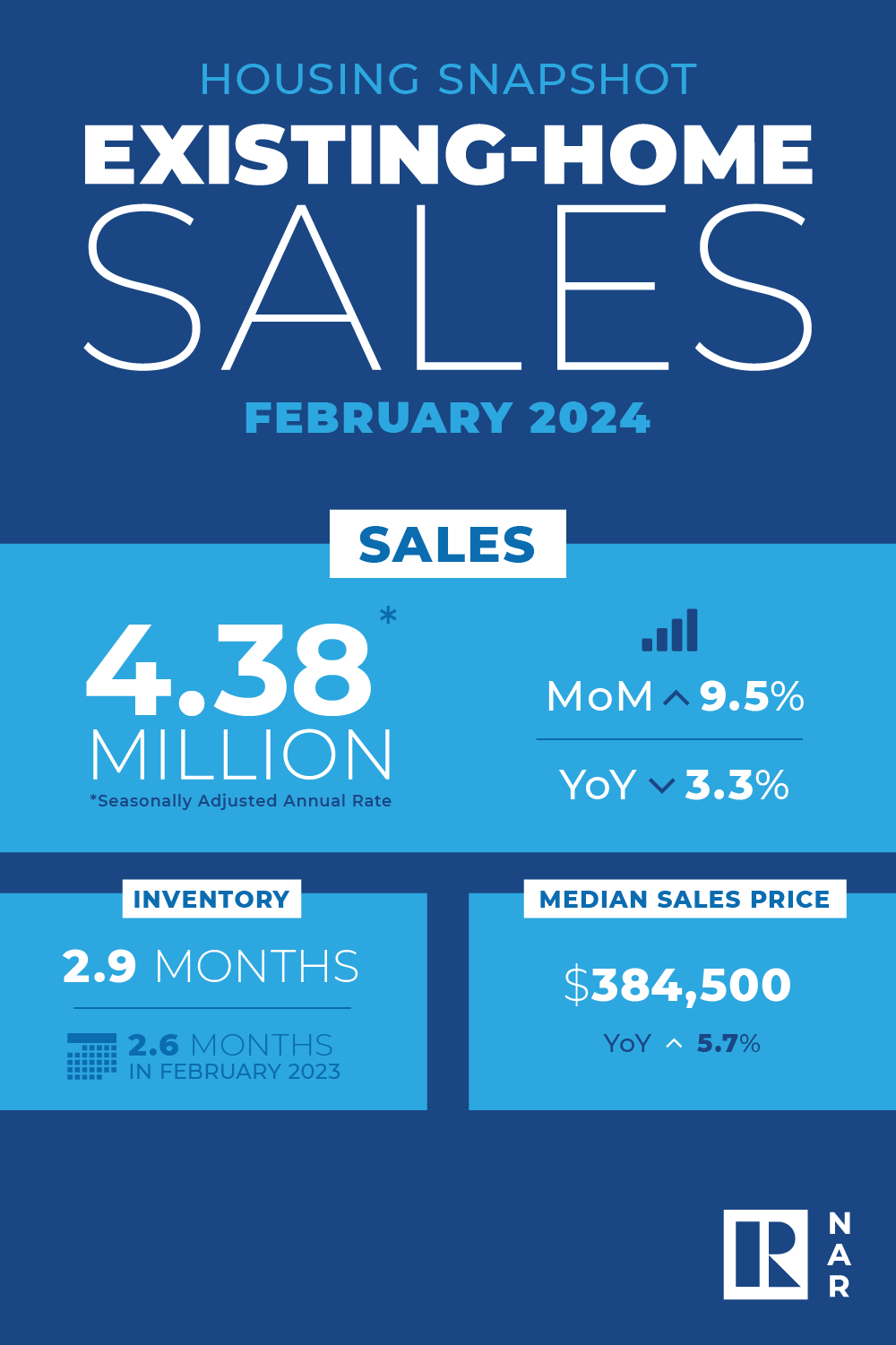

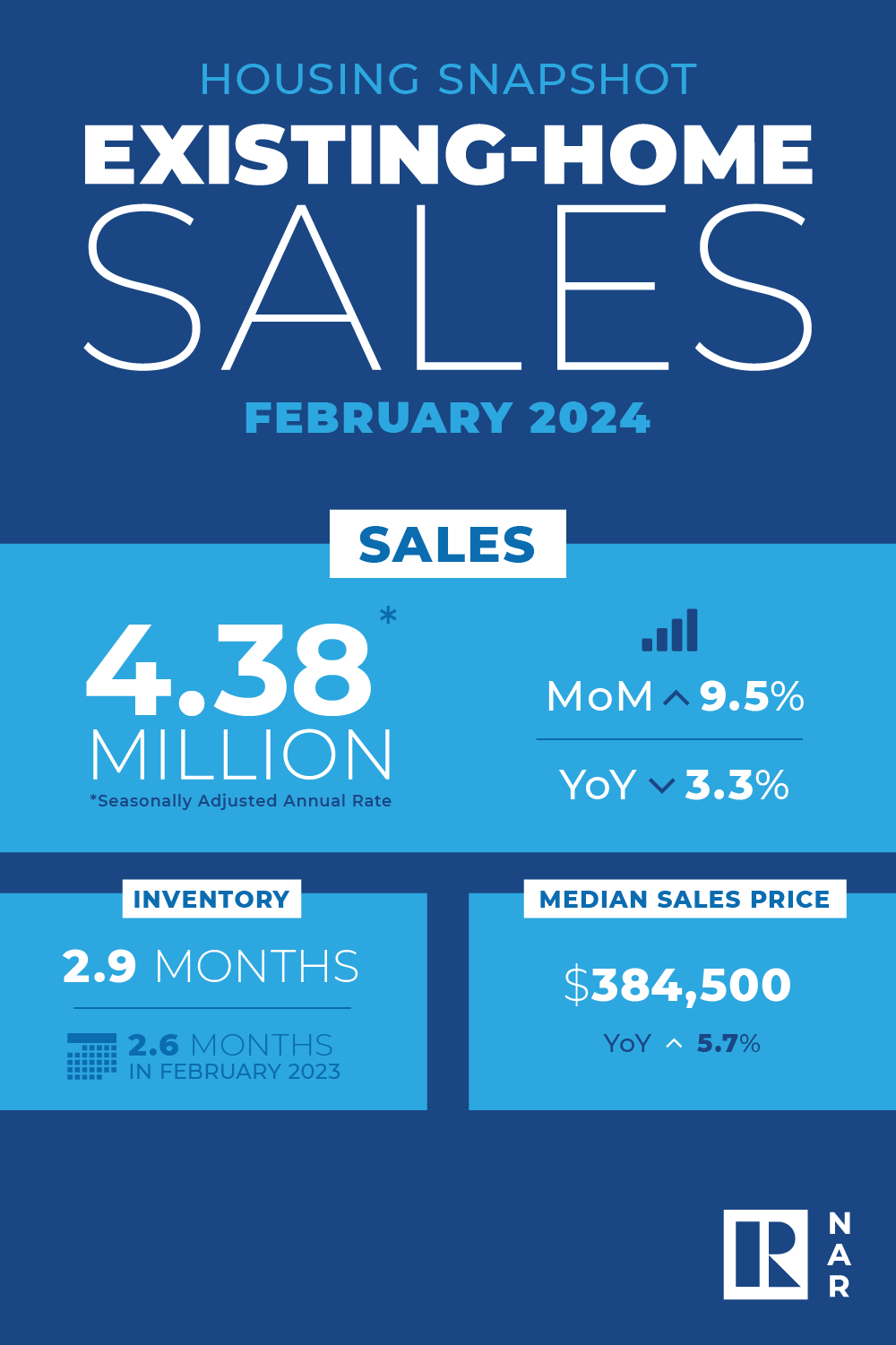

Note: Data below from February 2024 is the most recent from the National Association of Realtors.

Existing-home sales climbed in February, according to the National Association of REALTORS®. Among the four major U.S. regions, sales jumped in the West, South and Midwest, and were unchanged in the Northeast. Year-over-year, sales declined in all regions.

Total existing home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – bounced 9.5% from January to a seasonally adjusted annual rate of 4.38 million in February. Year-over-year, sales slid 3.3% (down from 4.53 million in February 2023).

“Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

“Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

Total housing inventory registered at the end of February was 1.07 million units, up 5.9% from January and 10.3% from one year ago (970,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.0 months in January but up from 2.6 months in February 2023.

The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). All four U.S. regions posted price increases.

According to the REALTORS® Confidence Index, properties typically remained on the market for 38 days in February, up from 36 days in January and 34 days in February 2023.

First-time buyers were responsible for 26% of sales in February, down from 28% in January and 27% in February 2023. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 2024 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 33% of transactions in February, up from 32% in January and 28% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 21% of homes in February, up from 17% in January and 18% in February 2023.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.74% as of March 14. That’s down from 6.88% the prior week but up from 6.60% one year ago.

Regional Breakdown

At 480,000 units, existing-home sales in the Northeast were identical to January but down 7.7% from February 2023. It’s the fourth consecutive month that home sales in the Northeast registered 480,000 units. The median price in the Northeast was $420,600, up 11.5% from one year ago.

In the Midwest, existing-home sales propelled 8.4% from one month ago to an annual rate of 1.03 million in February, down 3.7% from the previous year. The median price in the Midwest was $277,600, up 6.8% from February 2023.

Existing-home sales in the South leapt 9.8% from January to an annual rate of 2.02 million in February, down 2.9% from one year earlier. The median price in the South was $354,200, up 4.1% from last year.

In the West, existing-home sales skyrocketed 16.4% from a month ago to an annual rate of 850,000 in February, a decline of 1.2% from the prior year. The median price in the West was $593,000, up 9.1% from February 2023.

“Due to inventory constraints, the Northeast was the regional underperformer in February home sales but the best performer in home prices,” Yun added. “More supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences.”

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.” “Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

“Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”